Two Clouds develops bespoke fintech software that combines regulatory compliance, enterprise security, and exceptional user experiences. From payment platforms to digital banking, lending solutions to wealth management, we build custom applications that meet the unique demands of financial services.

Our fintech expertise spans the complete financial technology spectrum, delivering solutions that handle complex regulatory requirements whilst providing the flexibility and innovation that off-the-shelf platforms cannot match.

Explore SolutionsComplex FCA, PSD2, PCI DSS, and GDPR requirements that generic platforms cannot accommodate without significant customisation and ongoing compliance costs.

Outdated core banking systems preventing API connectivity, cloud deployment, and integration with modern fintech services.

Financial institutions face 300 times more cyberattack attempts than other industries, requiring tailored fraud detection and security architecture.

Connecting payment gateways, banking APIs, KYC providers, fraud detection systems, and accounting platforms into unified workflows.

Modern users expect instant onboarding, real-time transactions, and intuitive mobile-first interfaces that generic banking software cannot provide.

Platforms unable to handle transaction volume spikes, global expansion requirements, or rapid feature deployment needed for competitive advantage.

Comprehensive financial technology solutions designed for modern financial services

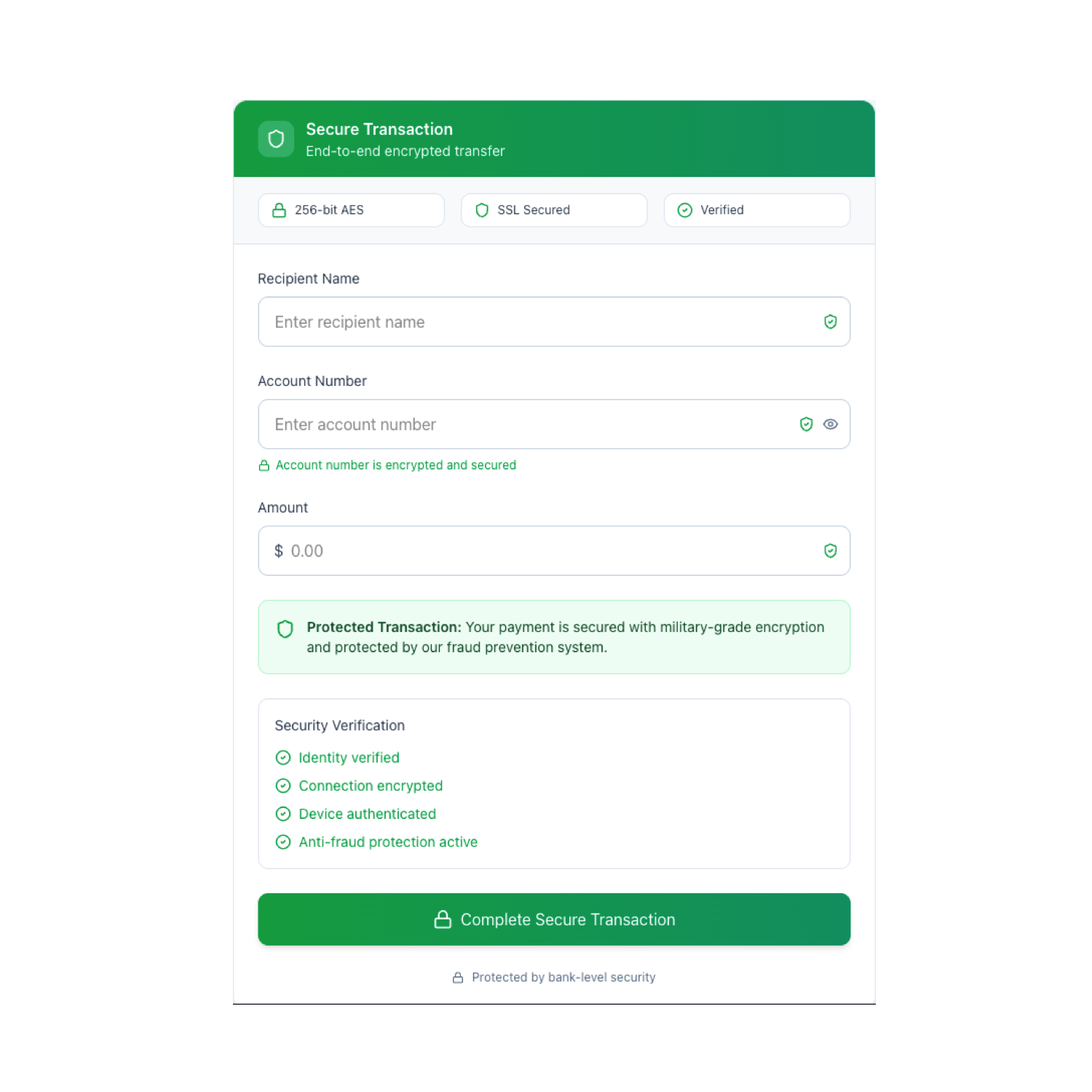

Custom payment gateways and processing solutions with multi-currency support, digital wallets, fraud detection, and PCI DSS compliance.

Neobank platforms with remote onboarding, account management, card issuance, P2P transfers, and multi-currency capabilities.

Loan origination systems with AI-powered credit scoring, automated underwriting, P2P lending, and real-time fraud detection.

Robo-advisory platforms with automated portfolio management, risk profiling, goal-based investing, and AI-driven analytics.

Automated KYC/AML verification, compliance monitoring, sanctions screening, and regulatory reporting for FCA and PSD2 requirements.

Banking-as-a-Service platforms with API-first architecture enabling financial services integration into non-financial applications.

Generic fintech platforms force compromises on compliance, security, and functionality. Our custom development approach means solutions built specifically for your regulatory requirements, risk profile, and competitive differentiation.

Deep expertise in FCA regulations, PSD2, Strong Customer Authentication, PCI DSS, and UK/Ireland post-Brexit compliance requirements.

PCI DSS-compliant architecture, encryption, tokenization, AI-powered fraud detection, and security-by-design principles.

Seamless connectivity with payment gateways, banking APIs, KYC providers, open banking platforms, and legacy systems.

API-first design, microservices, cloud-native infrastructure, and event-driven architecture for scalability and resilience.

Our fintech solutions address the complete financial technology ecosystem, from customer-facing applications through back-office compliance and third-party integrations.

Account aggregation, payment initiation, and PSD2 compliance with integration to UK Open Banking and European platforms.

Machine learning for credit scoring, fraud detection, risk assessment, and personalised financial recommendations.

Instant payment capabilities, real-time transaction monitoring, and sub-second fraud detection for modern payment expectations.

Understanding your regulatory obligations, security requirements, integration needs, and competitive positioning.

Designing PCI DSS-compliant infrastructure with encryption, tokenization, fraud detection, and audit capabilities.

Building with DevSecOps practices, continuous security testing, and iterative delivery enabling rapid market entry.

Ongoing regulatory updates, security monitoring, performance optimisation, and feature enhancements.

Based in Northern Ireland, we understand the unique regulatory landscape of UK and Irish financial services including post-Brexit compliance requirements, FCA regulations, and the evolving open banking ecosystem. Our fintech solutions serve startups, established financial institutions, and enterprises requiring secure, compliant financial technology.

Whether you're launching a new fintech product, modernising legacy banking systems, or need regulatory-compliant payment processing, we'd welcome the opportunity to discuss how custom development can accelerate your financial technology ambitions.

Ready to discuss your fintech software needs? Contact us to explore how we can help build secure financial solutions.

Contact UsEmail Us contact@twoclouds.co.uk

Call Us 028 9096 2852

Location Belfast, Northern Ireland